Answer:

b. Asset Turnover &

d. Profit margin.

Step-by-step explanation:

Return on asset (ROA) simply shows a percentage of how profitable companies assets are in generating the revenue. It is calculated as:

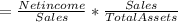

However, if we further break it down, we can write it as follows:

Both formulas Represent the same things.

But, the ratio of Net income to Sales is known as the Profit margin- A degree to which company makes money. Here, we can see how the ROA can be broken down in terms of profit margin.

Also, the ratio of Sales to Total asset is know as the Asset Turnover- a measure of company's use assets in generating the sales.

Hence, we can say that the ROA can be dis aggregated to reveal the Asset Turnover and the Profit margin.