Answer:

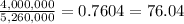

weight % of equity = 76.05%

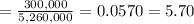

weight % of preferred stock = 5.70%

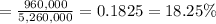

weight % of debt = 18.25%

Step-by-step explanation:

calculation for equity:

total number of equity is 100,000

market price of stock = 40

so total value of stock = 40 × 100,000 = 4,000,000

calculation for preferred stock:

total number of share is 10,000

market price of stock = 30

so total value of stock = 30 × 10,000 = 300,000

calculation for debt:

total number of bond is 1,000

market price of bonds = 960

so total value of stock = 960 × 1,000 = 960,000

total value = 4,000,000 + 300,000 + 960,000 = 5,260,000

Calculation of weight percentage

weight % of equity =

weight % of preferred stock

%

%

weight % of debt