Answer:

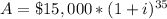

A. $115,291.30

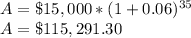

B. $421,536.55

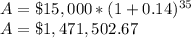

C. $1,471,502.67

Step-by-step explanation:

The expression that describes the final amount of a $15,000 investment compounded annually for 35 years is:

A. 6% per year

i = 0.06

B. 10% per year

i = 0.10

C. 14% per year

i = 0.14