Answer:

None of the given options.

The book value of equipment at the end of 2nd year would be $84,000.

Step-by-step explanation:

Cost = $100,000

Residual value = $20,000

Useful life = 10 years

Now,

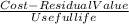

Annual straight line depreciation =

Annual straight line depreciation =

Annual straight line depreciation =

Annual straight line depreciation = $8,000

The book value of an asset can be calculated using the following formula:

Book value (ending) = Book value (beginning) - Depreciation expense

Depreciation table has been constructed for 2 years to calculate the book value of equipment at the end of year 2.