Answer:

So Option A has the highest return on common stockholders equity which is 17.8%

Step-by-step explanation:

First we will calculate the return on each each stockholder equity by using the following formula:

Return=(Net Income-preferred dividends)/Average common stockholder equity

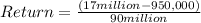

Part A:

Return=17.8%

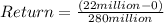

Part B:

Return=7.9%

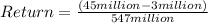

Part C:

Return=7.7%

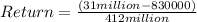

Part D:

Return=7.3%

So Option A has the highest return on common stockholders equity which is 17.8%