Answer:

$140,000

Step-by-step explanation:

Cost = $28,000,000

Residual value = $0

Expected miles = 200,000,000

Flying miles (year 1) = 1,000,000

Now,

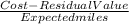

Depreciation per hour =

Depreciation per hour =

Depreciation per hour =

Depreciation per hour = $0.14

Depreciation expense (year 1) = Depreciation per hour × Working hours (year 1)

Depreciation expense (year 1) = $0.14 × 1,000,000

Depreciation expense (year 1) = $140,000