Answer:

$84,000

Step-by-step explanation:

Cost = $200,000

Residual value = $40,000

Expected hours = 20,000

Working hours (year 1) = 2,500 hours

Working hours (year 2) = 3,000 hours

Working hours (year 3) = 4,000 hours

Working hours (year 4) = 5,000 hours

Now,

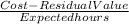

Depreciation per hour =

Depreciation per hour =

Depreciation per hour =

Depreciation per hour = $8

Depreciation exper for each year can be calculated using the units-of-production method. Under this method, depreciation expense per hours is multiplied with the hours used during each year.

Depreciation schedule for the machine has been constructed and attached below: