Answer:

cost of equity = 12.16 %

Step-by-step explanation:

given data

annual dividend of $3.73

increases dividend = 3.40 percent annually

stock price = $43.96 per share

to find out

What is the company's cost of equity

solution

we will use here Gordon model for compute company's cost of equity that is

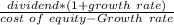

market value =

........................1

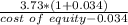

........................1

put here value we get

43.96 =

solve it we get

cost of equity = 0.121735

cost of equity = 12.16 %