Answer:

11.72%

Step-by-step explanation:

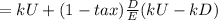

Find levered cost of equity using the formula below;

kL

whereby;

kU = unlevered cost of equity = 11% or 0.11 as a decimal

kL = levered cost of equity

D/E = debt-equity ratio = 0.4

tax = 40% or 0.40 as a decimal

Next, plug in the numbers to the formula above;

![kL = 0.11 + [(1-0.40)*0.4*(0.11-0.08)]\\ \\ =0.11 + 0.0072\\ \\ =0.1172](https://img.qammunity.org/2020/formulas/business/high-school/r3k5q2bz3cnnpfd6ejfvbsnt8vdg55s11w.png)

As a percentage, the King's levered cost of equity is 11.72%