Answer:

310500.

Step-by-step explanation:

Given: Net income= 470000

Issued common stock= 72000

Paid cash dividend= 11000

Paid cash to settle a note payable= 125000

Paid for treasury stock= 121000

Purchased equipment= 87000

Cash flow from financial activities are the cash inflow that are used to fund company. Here we consider all financial activities which involve cash.

We add all cash inflow from issuing debt and equity then deduct all cash outflow from stock repurchase, cash paid in dividend and other financial activities.

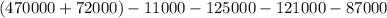

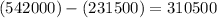

Cash flow from financial activities (CFF)=

Cash flow from financial activities (CFF)=

∴ Cash flow from financial activities is 310500.