Answer:

Depreciation in 2021 is $6,000

Depreciation in 2022 is $6,860

Book Value in 2022 is $19,940

Step-by-step explanation:

Given:

Total miles expected to be driven = 161,000 miles

Cost of taxi = $32,800

Salvage value = $600

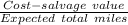

Depreciation as per unit of activity method =

=

= $0.2 per mile

Depreciation charge for a year is total miles driven multiplied by depreciation rate per mile.

Depreciation in 2021 = 0.2 × 30,000 = $6,000

Depreciation in 2022 = 0.2 × 34,300 = $6,860

Book value at the end of 2022 = Cost - depreciation for 2021 - depreciation for 2022

= 32,800 - 6,000 - 6,860

= $19,940