Answer:

Portfolio Beta = 1.2815

Step-by-step explanation:

given data

market value = $3,000,000

portfolio beta = 1.6

sells = 25

times index = $10

currently trading = 15379

to find out

anticipates that this hedge will reduce the portfolio beta to

solution

we get number of contract to sell is here

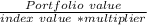

number of contract to sell = Portfolio Beta ×

......................1

......................1

put here value we get

25 = Portfolio Beta ×

solve it we get

Portfolio Beta = 1.2815