Answer:

Step-by-step explanation:

To find the value of Holding Period Return we use the following formula:

HPR = ((Income + End of Period Value - Original Value) / Original Value) * 100.

Here,

Income = Sum of all dividends = $2 * 100 +$3 * 100 + $4 * 100 = $900

End of perio Value = $18 * 100 = $1800

Original Value = $24 * 100 = $2400

Finally we will substitute above values in HPR formula, we get

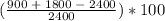

HPR =

HPR =

HPR = 12.5%.

Hence, the holding period return is 12.5%.