Answer:

number of shares to be used in computing diluted earnings per share for the year is 258400 shares

Step-by-step explanation:

given data

granted incentive stock = 28,000

common shares = $7 each

market price of common shares averaged = $10 per share

outstanding common stock = 250,000 shares

to find out

number of shares to be used in computing diluted earnings

solution

we get incremental outstanding share will be here

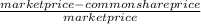

incremental outstanding share =

× granted incentive stock .................1

× granted incentive stock .................1

put here value we get

incremental outstanding share =

× 28000

× 28000

incremental outstanding share = 8400 shares

so

number of shares to be used in computing diluted earnings per share for the year is = incremental outstanding share + outstanding common stock

number of shares to be used in computing diluted earnings per share for the year is = 250000 + 8400

number of shares to be used in computing diluted earnings per share for the year is 258400 shares