Answer:

so cost of capital = 9.9 %

correct option is a 9.9%

Step-by-step explanation:

given data

capital structure = 40%

common equity = 60%

tax rate = 34%

pretax cost = 8.5%

pretax cost = 10%

market price = $59

Flotation costs = $3 per share

common stock dividend = $3.15

Dividends expected to grow = 7%

to find out

cost of capital if the firm uses bank loans and retained earnings

solution

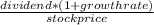

cost of retained earning =

+ growth rate ........................1

+ growth rate ........................1

cost of retained earning =

+ 0.07

+ 0.07

cost of retained earning =0.1271271186

and

cost of capital will be

cost of capital = weight for debit × ( cost of debit × ( 1 - tax rate ) ) + weight for common stock × cost of common stock

cost of capital = 0.40 × ( 8.5% × ( 1 - 0.34 ) ) + 0.60 × 0.1271271186

cost of capital = 0.0987

so cost of capital = 9.9 %

correct option is a 9.9%