Answer:

(A) $6.70

Step-by-step explanation:

Find dividends per year;

D1=0

D2=0.60

D3=D2(1+g); 0.60(1+0.04) = 0.624

discount rate = 12%

Next, find the PV of each dividend at t=0;

PV of D2 = 0.60 / (1.12) = 0.5357

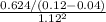

PV of D3 onwards =

PV of D3 = 7.8 / (1.12^2) = 6.2181

Then sum up these PVs to find the current value of stock;

Value = 0.5357 + 6.2181

Value = 6.7538

The closest value would be A.) 6.70