Answer:

share of pre bonus income = $33600

so correct option is B. $33,600

Step-by-step explanation:

given data

receive bonus = 20% of net income

partnership income before the bonus = $57,600

to find out

share of pre bonus income

solution

we know that share of pre bonus income will be here as

share of pre bonus income = Bonus + Share of remaining net income ..............1

put here value we get

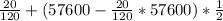

share of pre bonus income =

solve it we get

share of pre bonus income = $33600

so correct option is B. $33,600