Final answer:

Joe will have approximately $78,122.37 to retire on.

Step-by-step explanation:

To calculate how much money Joe will have to retire on, we can use the formula for compound interest: A = P

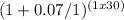

, where A is the future amount, P is the principal (initial amount), r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years. In this case, Joe's principal is 10% of his salary, which is $80,000 x 0.10 = $8,000. The annual interest rate is 7%, and the number of times interest is compounded per year is 1. Joe plans to save for 30 years, so t = 30. Plugging these values into the formula, we get A = $8,000

, where A is the future amount, P is the principal (initial amount), r is the annual interest rate, n is the number of times interest is compounded per year, and t is the number of years. In this case, Joe's principal is 10% of his salary, which is $80,000 x 0.10 = $8,000. The annual interest rate is 7%, and the number of times interest is compounded per year is 1. Joe plans to save for 30 years, so t = 30. Plugging these values into the formula, we get A = $8,000

. Using a calculator, we find that Joe will have approximately $78,122.37 to retire on.

. Using a calculator, we find that Joe will have approximately $78,122.37 to retire on.