Answer:

The value of the stock today is $4.86

Step-by-step explanation:

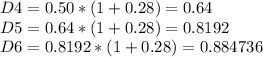

Hi, first we need to find the value of dividend 4, 5 and 6, ths las one we will use to find the perpetuity value of this stock (since it will grow at 8% from year 5). So, let´s go ahead and find D4, D5 and D6

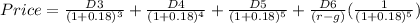

Now, we need to find the price of this stock, for that we have to bring to present value all those cash flows.

Where:

r = required return of Computech

g= growth rate from year 5 (8%)

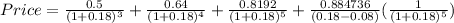

Everything should look like this.

Therefore:

So, today´s value of this stock is $4.86