Answer:

straight line method = $2,700

Using Double declining rate = $6,200

Activity based = $4,050

Step-by-step explanation:

Data provided:

Purchasing cost of the store equipment = $31,000

Service life = 10 years

Salvage value = $4,000

Useful life = 10,000 hours

Number of hours equipment used for the first year = 1,500

Now,

Depreciation using the straight line method

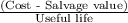

Annual depreciation =

=

= $2,700

Using Double declining rate

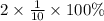

Double declining rate =

= 2 × 0.1 × 100%

= 20%

Therefore,

Depreciation for the first year = $31,000 × 20%

= $6,200

Activity based

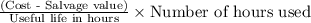

=

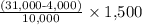

=

= $4050