Answer:

current share price = $5.40

so correct option is C. $5.40

Step-by-step explanation:

given data

dividends paid = 15 years

pay = $6 per share

increase = 4%

to find out

current share price

solution

we know that Value after year 15 will be = ( D15 × Growth rate) ÷ (required return - growth rate) ......................1

put here value

Value after year 15 =

Value after year 15 = $52

so here current share price will be

current share price = Future dividends × Present value of discounting factor

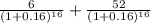

current share price =

current share price = $5.40

so correct option is C. $5.40