Answer:

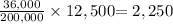

First year depreciation expense is $2,250

Step-by-step explanation:

Total depreciation expense is given by:

Price - Salvage Value = 40,000 - 4,000 = 36,000

That $36,000 depreciation expense would be spread out for 200,000 miles.

So for the first year in which the truck is used 12,500 miles, the depreciation expense will be

Question answered.

Note: