Answer:

$2.125

Step-by-step explanation:

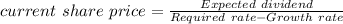

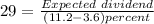

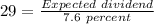

First, we calculate the expected dividend for year-1:

Expected dividend = $29 × 7.6%

= $2.204

Current dividend share paid on the stock:

= Expected dividend - (Expected dividend × Growth rate)

= $2.204 - ($2.204 × 3.6%)

= $2.125