Answer:

It will price the annuity service at 6,391.68 dollars

Step-by-step explanation:

The company will earn at 7% from the amount charged at the customer. To make 1% it will discount at 6% (7% - 1%) This will make the present value of the annuity lower that if earned at 7% This difference is the gain for County Ranch.

C $500

time 25 years

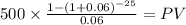

rate 0.06

PV $6,391.6781