Value of shipment having tariff charges is $1,200,000

Solution:

Given that Stellar Electronics is selling products in a foreign country that charges 10% tariff on shipping into the country.

For a particular shipment tariif = $120,000

Need to determine value of the shipment

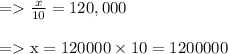

Let’s assume the value of the shipment = x

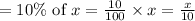

As from given information, tariff on shipping = 10 % of value of shipment

So tariff on shipment having value of x

But it’s given that tariff on shipment = $120,000

Hence value of shipment having tariff charges is $1,200,000