Answer:

B. $1,639

Step-by-step explanation:

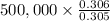

To do arbitraje we will ask at Bank A for $0.305

and then bid in Bank B at $0.306

As the transactions has no cost we are doing a profit by using the exchange as they allowed. Doing this procedure will at some point eliminate the difference in exchange rate for these bank as the purchase will rise the ask rate for Bank A and the sale will decrease the bid rate.

Total: 501639,3442622951

The profit will be for: 501,639.34 - 500,000 = 1,639.34