Answer:

James' credit union loan rate is 8.88% APR, the local bank loan rate is 9.34% APR.

Step-by-step explanation:

Hi, since in both cases payments would be done in a monthly basis, we have to assume that the rate that we are looking for is APR (compounded monthly), and since there is no additional information in regards that 9.25% rate, we can assume that this is effective annually, so let´s convert this effective monthly rate into APR (compounded monthly)

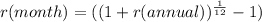

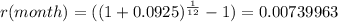

First, we have to convert it into an effective monthly rate, that is:

Then we multiply by 12 and we get 0,088796 , which is 8.88% APR (compounded monthly)

This way James can compare both credits. The cheaper loan is from the credit union.