Answer:

The face value of each bond was $1,100

Step-by-step explanation:

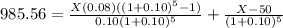

Hi, well, first we have to assume that all the future cash flows make sense to the owner of the bonds, that is, we are assuming that he paid the fair price for all the bonds and since they were 10, the price of each bond was $9,855.57/10= $985.56.

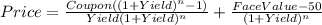

Now, we need to find the face value of the bond, taking into account that we planned to sell the bonds $50 less than its face value, therefore the equation that we need to solve for "X" (X being the face value of the bond) is:

Where:

Coupon = X * 8%

Yield = owner´s money yield

n = periods of payment

X = Face Value

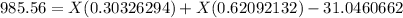

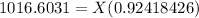

So, it should look like this:

So, the face value of each bond was $1,100

Best of luck.