Answer:

0.3215 or 32.15%

Explanation:

Data provided in the question:

Sales by Stokes Technologies = $350 million

fixed assets = $150 million

Fixed Assets/Sales ratio = 42.86%

capacity = 75%

Now,

Sales at full capacity =

or

Sales at full capacity =

or

Sales at full capacity =

or

Sales at full capacity = $466.67 million

Thus,

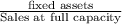

Fixed Assets/Sales ratio =

or

Fixed Assets/Sales ratio =

or

Fixed Assets/Sales ratio = 0.3214

or

= 0.3214 × 100% = 32.14%