Answer:

It should sale the car for at least 6.853,55 to pay up the loan

Step-by-step explanation:

We need to calculate the balance of the loan after 3-years

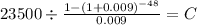

Montly payment:

PV 23,500

time 48

rate 0.009

C $ 605.090

interest:

23,500 x 0.009 = 211.50

amortization on first period:

605.09 - 211.5 = 393.59

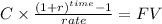

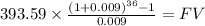

Amortization after three years: future value of an annuity of the first amortization

C 393.59

time 36

rate 0.009

FV $16,646.4462

Balance: 23,500 - 16,646.45 = 6.853,55