Answer with Step-by-step explanation:

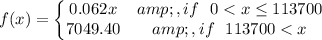

We are given that

If you earned upto $113,700 in 2013 from an employer then your security tax=6.2% of income

If you earned over $113,700 then, you paid amount of tax=$7049.40

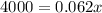

We have to find the money you would have made when you paid $4000 in social security tax in 2013.

Let x be the income and f(x) be the amount of tax.

Substitute the values then we get

$64516.13

$64516.13

When you would have mad $64516.13 then you paid $4000 in social security tax in 2013.