Answer:

YTM on bond B: 11.80%

Step-by-step explanation:

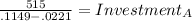

Investmetn A is a perpetuity with a grow rate of 2.21% and required return of 11.49%

the present value is:

A=5549.568966

if Kyan holding value is 6,600 then the bond present value is:

6,600 - 5,549.57 = 1,050.43

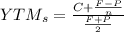

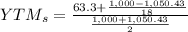

Now we need to calcualte the YTM for bond B:

Coupon payment =1,000 x 12.66%/2 payment per year = $ 63.3

Face Value = 1000

Present value= 1050.43

n= 9 years x 2 payment per year = 18

![YTM_s = \frac{63.3 + (60.49833333)/(1025.215)]()

YTMs = 5.9010386%

This is a semiannual rate, as we were working with semiannual payment

to get the YTM we multiply by 2 and get:

YTM: 0.118020773 = 11.80%