Answer:

option 14.92%

Step-by-step explanation:

Data provided in the question;

Expected annual dividend to be paid = $0.65

Expected growth rate = 9.50%

Walter’s stock currently trades = $12.00 per share

Now,

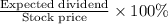

Expected rate of return =

+ Growth rate

+ Growth rate

or

Expected rate of return =

+ 9.50%

+ 9.50%

or

Expected rate of return = ( 0.054167 × 100% ) + 9.50%

or

Expected rate of return = 5.4167% + 9.50%

or

Expected rate of return = 14.9167 ≈ 14.92%

Hence, the correct answer is option 14.92%