Answer:

the intrinsic value of the share is 71.03 dollars

That is the amount a rational investor would purchase the share.

Step-by-step explanation:

there is a negative grow on the dividends thus, lowering the stock price according to the gordon model

d0 =11

d1 = d0 (1 + g)

being g = 4.75% negative:

11 (1 - 0.0475) = 10,4775

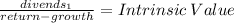

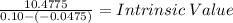

Then, we calcualate the ntrinsic value of the share:

Intrinsic value: 71,0338983 = 71.03 dollars