Answer:

it will approximately be 4650 per value

Explanation:

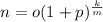

well, if you know this rule then this problem will be fine to you

such that n represents the price you want in k years for every m years

and p is the percent of the interest or increase or decrease

and o is the original or initial quantity

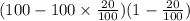

i will help you understand the concept of this rule.for example when you have 100 cakes and you eat 20% per trial .Then, the first trial there is 80 cakes remain.the second trial

there will be 64 cakes remain

now to get the general formula for it

now you get the concept of the formula

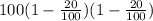

lets move to our problem

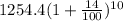

first you will this formula for 2 years

it will give you 1254.4

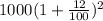

now you will consider this as the initial quantity in the formula for 10 years

it will give you the answer