Answer:

correct option is b i.e 51020.41

Step-by-step explanation:

Given Data:

Machinery cost $45000

cash flow in first year = $25000

cash flow in second year $30000

Interest rate is 5%

we know that present value can be obtained by using following relation

where PV is present value

FV is future value

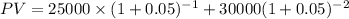

Therefore present value is computed as

PV = 51020.41

Therefore correct option is b i.e 51020.41