Answer:

$12,480

Step-by-step explanation:

Given:

Amount paid for direct material = $12,240

production workers' wages = $10,700

Lease payments and utilities on the production facilities amounted = $9,700

general, selling, and administrative expenses = $3,800

Units produced = 6,800 units

Units sold = 4,200

Unit price of a unit = $7.30

Now,

Per unit Cost of production =

or

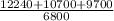

Per unit Cost of production =

or

Per unit cost of production = $4.80

Also,

Units left in the inventory = Total units produced - Units sold

= 6,800 - 4,200

= 2,600

Thus,

Amount of finished goods inventory on the balance sheet at year-end

= units left in the inventory × Per unit cost of production

= 2,600 × $4.80

= $12,480