Answer:

the bank is the best option as it can purchase the car with monthly payment of 223.71 while the other option are payment for 291

Step-by-step explanation:

option 1 291 per month

option 2

we can chose for a 4.5 loan or a 5.5 loan so we will pick the bank as it is lower and compare with the 291 of dealer 1

the loan of 12,000 at 4.5% APR

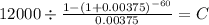

we need to calculate the PTM of an ordinary annuity of 5 years discounted at 4.5%

PV $12,000.00

time 60 (5 years x 12 months per year)

rate 0.00375 (we divide the annual rate by 12 to convert it to monthly)

C $ 223.716