Answer:

20%

Step-by-step explanation:

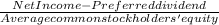

Return on common stockholders' equity is a ratio that shows how successful a company is in generating a return for the equity holders. It is worked out by dividing the net income available for common stockholders by common stockholders’ equity. It is expressed by the following formula:

Income available to common stockholders

=

Thus, return on common stockholders' equity

=

=

= 20%