Answer:

Current price = $10.15

Step-by-step explanation:

Given data:

Annual dividend $1.00

growth rate 10% for 2 year then 20%

Therefore,

1st Year dividend = 1 * 1.1 = 1.1

2nd Year dividend = 1.1 * 1.1 = 1.21

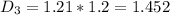

3rd Year dividend

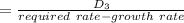

Value at year 2

Value at year 2

Value at year 2

Value at year 2 = 14.52

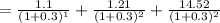

Current price

Current price = $10.15