Answer:

Ans. The firm’s value of operations, in millions is $82.61 millions

Step-by-step explanation:

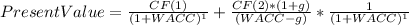

Hi, we need to bring to present value all cash flows, so we need to bring the -10 million to present and the perpetuity value too, the full equation to use is as follows.

Where:

CF(1)= -10

CF(2)=10

WACC=weighted average cost of capital

g= Constant growth rate

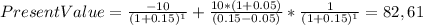

It should look like this.

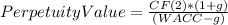

the constant growth rate is found by the second part of the equation

And that brings all the future cash flows to 1 period before its first cash flow, but there is still one period to go in order to take it to present value, so we discounted with.

so the answer is $82.61 millions.

Best of luck.