Answer:

Market value of Katie Pairy Fruits bonds: $3,952.40

Step-by-step explanation:

To know the current market value of the bond we will calcualte the present value of the coupon payment and the present value of the maturity:

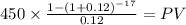

The coupon values will be done using ordinary annuity:

Coupon payment: $450

time 17 years

rate 0.12 (we use market rate)

PV $3,588.29

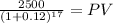

and the maturirty with the present vlaue of a lump sum

Maturity $2,500

time 17 years

rate 0.12 (market rate)

PV $364.1109

PV coupon $3,588.2938

PV maturity $364.1109

Total $3,952.4046