Answer:

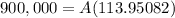

Ans. Your mortgage payment will be $7,898.14 per month.

Step-by-step explanation:

Hi, first, we need to find the equivalent effective monthly rate for 10% APR, that is 10% / 12= 0.8333% effective monthly.

After that, we have to present the periods of the loan in months, that is 30 years * 12 = 360 months

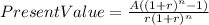

Now, we are ready to find the answer, we need to use the following equation and solve for "A"

Where:

A= our answer

r= interest rate (0.8333% effective monthly)

n= periods of periodic payment (in our case 360 months)

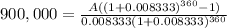

The math to this is as follows.

Best of luck.