Answer:

COV (all stocks) = 0.55

COV (stocks and bonds) = 0.82

Explanation:

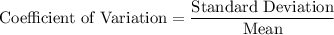

Coefficient of Variation is used to measure variability.

It is defined as the ration of standard deviation and the mean.

It can be used to compare variability of two population or two samples.

Formula:

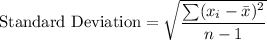

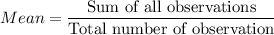

where

are data points,

are data points,

is the mean and n is the number of observations.

is the mean and n is the number of observations.

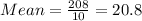

x: 14, 0, 39, 25, 32, 27, 28, 14, 14, 15

y = 6, 2, 29, 17, 26, 17, 17, 2, 3, 5

Since coefficient of variation of x is less compared to y, thus it could be said bonds does not reduce overall risk of an investment portfolio.