Answer:

a) About 12%

Explanation:

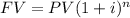

We need to find the interest rate required to achieve her goal, so we will need to use the interest-compound formula:

Where:

PV= Present Value

i= interest rate

FV= Future Value

n= number of periods

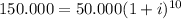

replacing the data provided:

solving for i:

first, divide both sides by 50.000 to simplify the equation:

Take

roots of both sides:

roots of both sides:

±

±

![\sqrt[10]{3}](https://img.qammunity.org/2020/formulas/mathematics/high-school/h112f6e67qx6w7aylh6901q15ctsk2brlu.png)

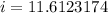

solve for i:

±

±

![\sqrt[10]{3} -1](https://img.qammunity.org/2020/formulas/mathematics/high-school/aamd5f43bgrs1puaqg2jtqzsoom05fu93y.png)

We get two answers, but we look for a coherent value. So we take the positive one:

≈12

≈12