Answers:

a) PV 27,207.65

b) PV 111,152.34

c) PV 28,568.03

d) PV 112,541.74

Step-by-step explanation:

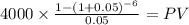

The formula for an annuity present value is as follows:

For each case we will plug the values into and solve:

A)

C 4,000

time 6

rate 0.05

PV $27,207.6513

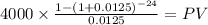

B)

C 4,000

time 24 (6 years x4 quearter per year)

rate 0.0125 (5% annual divided by 4 quearter per year)

PV $111,152.3361

C) same as A) but being an annuity-due, whch means the payment are made at the beginning of the period:

ordinary annuity x (1+r) = annuity-due

$27,207.6513 x 1.05 = $28,568.0338

D) same procedure as C:

ordinary annuity x (1+r) = annuity-due

$111,152.3361 x 1.05 = $112,541.7403