Answer:

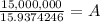

Ans. The equal annual amount that the firm must save to this account to accumulate the $15 million by the end of 10 years is $941,180.92

Step-by-step explanation:

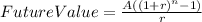

Hi, we have to use the following equation and solve for "A". The equation is as follows.

Where:

A= Annuity (amount of money to save every year)

r= interest rate (in our case, 10% annually)

n= Quantity of yearly savings (10 contributions at the end of each year)

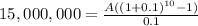

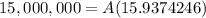

Everything should look like this

So, in order to accumulate $15 million in 10 years at a rate of 10% annually, Knutson Corporation must make 10 equal contributions of $941,180.92 every year, at the end of each year.

Best of luck.