Answer:

a-1// 8,979.49

a-2// 9613.14

b-1// 5,154.36

b-2// 4,676.51

Step-by-step explanation:

We will calculate each present value using the formula for present value of an ordinary annuity:

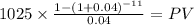

a-1

C 1,025

time 11

rate 0.04

PV $8,979.4886

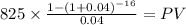

a-2

C 825

time 16

rate 0.04

PV $9,613.1439

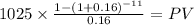

b-1

C 1,025

time 11

rate 0.16

PV $5,154.3605

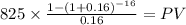

b-2

C 825

time 16

rate 0.16

PV $4,676.5098