Answer:

The after tax cash flow will be $112,000.

Step-by-step explanation:

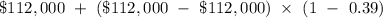

The market value of the fixed asset is given at $112,000.

The book value of the same asset is $112,000.

The marginal tax rate is 39%.

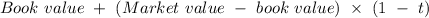

The after tax cash flow will be

=

=

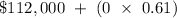

=

= $112,000