Answer:

a) $765.13 b) $277,601.23

Explanation:

a) The problem is an example of an ordinary annuity (deposits at the end of the period).

The future value of this type of annuity is:

Clearing the annual deposit A

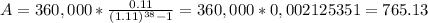

The deposit needed to have $360,000 in 38 years is $765.13

b) We can use the same formula to compute the FV of a known deposit:

With annual deposits of $590 you will have at 38 years an ammount of $277,601.23